Accounting Software for Trucking Company

- What Is Trucking Accounting Software?

- Why You Need Accounting Software for Your Trucking Business

- How to Choose the Right Trucking Accounting Software

- Trucking Accounting Software Best Features

- Benefits of Trucking Accounting Software

- Best Trucking Accounting Software

- Ready to Take Control of Your Trucking Finances with Trucking365 TMS's Accounting Module?

What Is Trucking Accounting Software?

Managing the finances of a trucking company requires not only specialized knowledge and experience but also specialized software that is designed exclusively for logistics companies to solve the problems of the freight business. Trucking accounting software provides fleet operators, owner-operators, and logistics companies with the financial control needed to stay profitable in the competitive freight market.

Why You Need Accounting Software for Your Trucking Business

Trucking is a business that operates on a thin profit margin, so controlling expenses and revenues is critical. Manual accounting methods often lead to errors and compliance issues that can cost thousands of dollars.

Truck accounting has many unique features, such as calculating cost per mile, managing fuel surcharges, tracking maintenance costs for multiple vehicles, and preparing specialized tax forms such as Form 2290 and IFTA returns. In such an environment, standard accounting software cannot be used effectively.

Cash flow management is the most crucial part of any business. Trucking often faces delayed payments from brokers and shippers, which can even lead to bankruptcy of the trucking company. Good trucking accounting software can automatically send invoices to the broker, track the payment status of the invoice, and inform you about unpaid invoices.

Saving time is another compelling reason to invest in trucking accounting software. What used to take hours of manual labor from multiple departments can now be done in minutes, allowing business owners to focus on operations rather than paperwork.

How to Choose the Right Trucking Accounting Software

Choosing the right accounting software for your trucking business should start with a thorough analysis of your company’s specific needs and budget. Start by assessing your current financial processes and identifying problems that software can solve.

Consider the scale and complexity of your business. Owner-operators with one truck have different needs from large trucking companies with hundreds of vehicles. Look for software that can scale as your business grows while still providing all the features you need.

Your accounting software should easily interact with your existing systems, including dispatch software, fuel cards, electronic logging devices, and banking platforms. This integration eliminates duplicate data entry and reduces errors.

Evaluate the software’s reporting capabilities. Look for solutions that provide industry-specific reports, such as truck profit and loss reports, trip cost analysis, and fuel efficiency tracking.

Ease of use is essential, especially if you’re not an accounting expert. Choose software with an intuitive interface and good customer support.

Cloud-based software offers benefits such as automatic updates, remote access, and lower initial costs, while on-premises solutions provide greater control over data and customization options.

Trucking Accounting Software Best Features

Centralized Load Data to Reduce Manual Entry

Modern trucking accounting software centralizes all load information in one place. This feature eliminates the need for manual data entry across multiple systems, reducing errors and saving time.

A centralized system should automatically capture load information, including pickup and delivery locations, freight costs, fuel surcharges, and additional expenses. This information should enable the accounting system to create accurate financial reports without the need for manual intervention.

This centralization enhances the transparency of freight profitability, allowing users to quickly analyze which loads, customers, and routes are generating the most profit. It enables more informed business decisions and strategic planning.

Manage Income and Expense Transactions

Adequate revenue and expense management is the key to success in the trucking industry. Quality accounting software should provide tools to accurately and reliably track all revenue and expense sources.

The software should be able to classify transactions based on predefined categories. This option reduces the risk of misclassifying expenses, which can lead to under-taxing or inaccurate financial reporting.

The system should be able to track specialized expense categories related to trucking, such as fuel costs, maintenance costs, permits and licenses, insurance, and equipment depreciation.

The software should also allow you to track per-mile costs and provide this value for each vehicle or driver.

The system should also automatically calculate driver payroll based on its established labor rate.

Revenue management features should allow you to track all payments as well as invoices that are past due.

Recurring Deductions and Reimbursements

Trucking involves many repetitive tasks that can be automated. The best accounting software should automatically handle these repetitive tasks, ensuring accuracy and saving time.

Standard recurring deductions include insurance payments, equipment payments, permit renewals, and subscription fees for various services. The software can automatically schedule these deductions and add them to invoices or driver settlements.

Driver reimbursement is another area where automation provides significant benefits. The system can automatically calculate and process reimbursements for fuel, meals, lodging, and other approved expenses.

Managing and Factoring Invoices

Invoice management is critical to the operation of a trucking company. Quality accounting software provides the tools to create, send, track, and collect invoices efficiently.

The software automatically generates invoices based on completed loads, including all relevant expenses and load documentation. This automation ensures prompt invoice submission, improving cash flow and reducing the risk of late payments.

For companies using factoring services, the software can integrate directly with factoring companies to automate the invoice submission process and speed up the receipt of invoice payments.

Invoice tracking features provide real-time tracking of outstanding accounts receivable. Users can quickly identify overdue invoices and take appropriate collection actions to minimize outstanding balances.

Use Document Uploads to Eliminate Paperwork

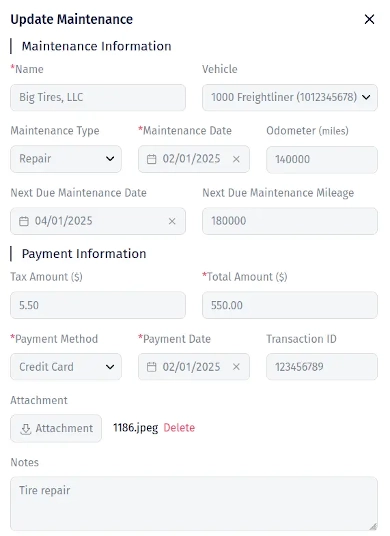

Modern trucking accounting software includes powerful document management features that allow you to store, organize, and retrieve essential business documents.

Users can upload and attach supporting documents directly to transactions, loads, or customer and driver records. These can include expense receipts, fuel receipts, maintenance records, etc. Electronic storage of these documents and easy access to them improve business efficiency.

Document retention policies ensure that essential records are retained for the required period, automatically deleting obsolete documents. This automated management reduces storage costs and ensures compliance with record-keeping requirements.

Customizable Reporting and Analytics

Having all the data in one place and the availability of various reports make trucking accounting software a powerful business intelligence system.

Standard reports include profit and loss statements, balance sheets, cash flow statements, and tax forms specific to the trucking industry.

Advanced analytics provide deeper insights into business performance trends, seasonal patterns, and operational efficiencies. This data helps identify opportunities for improvement and supports strategic planning.

Benefits of Trucking Accounting Software

| Benefit | Description |

| Save Time by Automating Everyday Tedious Tasks |

Automation is one of the most important benefits of modern trucking software. Tasks that used to require hours of manual work can now be completed in minutes, freeing up valuable time for more strategic tasks. Automated data entry eliminates the need to manually enter information from fuel cards, expense receipts, and load documents. The software collects this information electronically and categorizes it accordingly, reducing both time and errors. Routine financial processes such as invoice generation, driver settlements, and payment processing can be performed automatically. This automation ensures that these critical tasks are completed on time. Report generation is simplified by automated systems that can generate and distribute financial reports with a single click or on a schedule. Business owners can receive daily, weekly, or monthly reports without having to worry about manually compiling them. |

| Prevent Costly Errors |

Manual processes in finance are prone to human error, and errors in trucking accounting can be costly. Automated accounting software significantly reduces errors with built-in validation features. Data entry errors are minimized with automated data capture and validation. When manually entering information, the software can identify potential errors such as duplicate data, non-standard amounts, or missing required fields. Calculation errors are virtually eliminated when the software handles complex calculations such as fuel tax, maintenance costs, and driver payroll. These calculations are performed consistently and using the same formulas. |

All the best transportation management systems should provide these benefits.

Best Trucking Accounting Software

Best Trucking Accounting Software for Owner Operators

Owner operators have unique needs that differ from those of larger trucking companies. The best single-truck accounting software is simple, affordable, and easy to use while still providing the core features specific to trucking.

Look for solutions that are easy to set up and intuitive to use, without requiring extensive accounting knowledge. The software should handle basic accounting tasks while still providing specific features like IFTA reporting and per-mile expense tracking.

Mobile accessibility is especially important for owner-operators who spend a lot of time on the road. Look for software with robust mobile apps or web access that works well on smartphones and tablets.

Cost-effectiveness is critical for owner-operators working on a budget.

Look for solutions that offer fair pricing without sacrificing core features. Some providers offer special pricing plans designed specifically for single-truck operations.

Integration with popular fuel cards, electronic logging devices, and banking platforms can significantly improve the efficiency of owner-operators. Such integration reduces manual data entry and ensures accurate accounting.

All these functions can be solved by TMS for owner operators.

Ready to Take Control of Your Trucking Finances with Trucking365 TMS's Accounting Module?

Tired of juggling spreadsheets, chasing broker payments, and manually calculating cost-per-mile? Trucking accounting software is designed to address precisely those pain points, offering tools to manage finances, invoices, payroll, cost per mile, and specialized tax reporting, such as IFTA, all in one place.

With trucking margins tight and delayed payments threatening your cash flow, you need a solution that not only auto-sends invoices but also tracks payment status and alerts you to unpaid bills.

Save time. Reduce errors. Stay compliant.

Get started now:

Sign up for a Free Trial and experience how Trucking365 TMS's accounting module can streamline your back-office in minutes.

Schedule a Demo to see how our specialized accounting tools - built for trucking - can help you manage expenses, track per-mile costs, and automate invoicing with ease.

Drive profitability, not paperwork. Start your free trial or book a demo today!